In this issue, we will explain subrogation and waiver of indemnity in ocean cargo marine insurance.

Subrogation and Reimbursement

If damage to the cargo occurs and the cause of the damage is attributable to the carrier (shipping company/land agent/warehouse operator or other cargo consignee), the shipper may claim compensation from the carrier based on the contract of carriage.

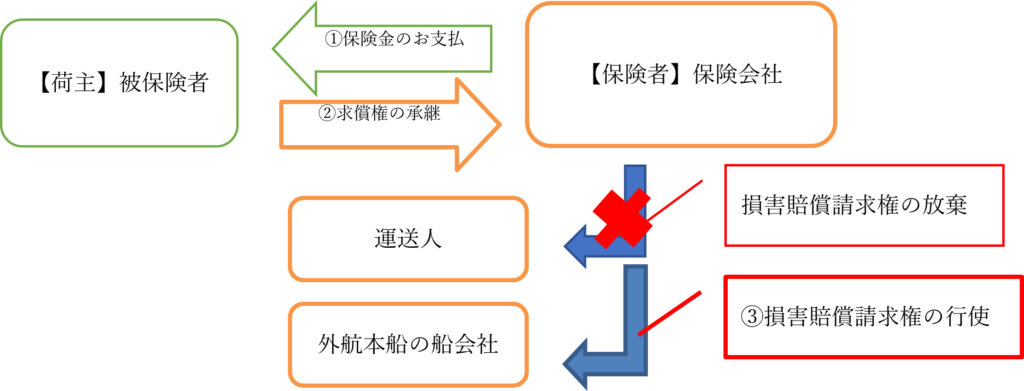

If the shipper receives insurance benefits for damage to the cargo under the insurance contract with the insurance company, the insurance company succeeds (subrogates) the shipper's right to claim damages (right of recourse) against the carrier.

*This does not transfer ownership of the cargo.

*Set forth in Section 79 of the Marine Insurance Act 1906 (UK), the law governing English insurance policies.

When the insurance company assumes (subrogates) the right of indemnity from the insured, the shipper, upon payment of the insurance claim, the insurance company exercises this right and claims compensation from the carrier. This is calledsubrogationIt is called.

Usually, a Subrogation Receipt is signed by the shipper-insured and submitted to the insurance company, which certifies that the insurance company has subrogated the right of indemnity through payment of the insurance claim.

Insurance companies use maritime attorneys to subrogate and seek reimbursement, but the reimbursement process takes time and the amount of reimbursement received is usually not very large in relation to the insurance payment made.

Article 79 Right of Subrogation

(1) If the insurer has paid for the total loss of the whole of the insured object or, in the case of cargo, of a divisible part of the insured object, the insurer shall thereby be entitled to succeed to any interest which the insured may have in the remaining part of the insured object for which payment was made, and shall thereby be (2) The insurer shall be subrogated to all rights and remedies of the insured with respect to the insured object itself and with respect to the insured object from the time of the occurrence of the disaster causing the damage.

There are two major implications of subrogation reimbursement by insurance companies.

The insurance result is calculated by deducting the amount recovered through subrogation from the insurance payment. Therefore, the shipper's insurance result will be improved by subrogation.

This will serve as a reminder to carriers who have caused accidents, and is expected to reduce the number of cargo handling accidents.

2. waiver of right of indemnification

As mentioned above, the insurance company acquires the right of indemnification subrogated by the insurance payment, but there may be cases where exercising this subrogated right of indemnification may cause certain problems for the insured, the shipper (e.g., if the third party subject to indemnification is a subsidiary of the insured).

In such cases, an insurance contract can be concluded with a prior agreement to waive the right of subrogation (waiver of subrogation clause). Specifically, a "Waiver of Subrogation Clause" is attached to the terms and conditions of marine insurance. However, the waiver of subrogation clause does not include the carrier of the ocean-going vessel.