When sending goods from Japan to individuals in China, there are restrictions on price and quantity.

If you send your goods without knowing it, they will be stopped by Chinese customs and sent back to Japan or disposed of. The goods may be sent back to Japan or disposed of.

In this issue, we have compiled the knowledge you need to know about shipping to China.

2. What goods cannot be sent to China?

3. What is not personal cargo?

4. Are customs duties charged on personal shipments?

5. What is the duty rate on personal shipments?

6. Who pays customs duties on personal shipments?

7. What happens if I do not pay the customs duty?

8. Personal shipment invoice pricing

9. If the freight value exceeds NT$1,000

10. What documents are required by Chinese customs?

1. What is the difference between private and commercial cargo?

Customs procedures for shipments to China differ for personal and commercial shipments.

Procedures for Private Cargo

Private Cargo is defined asThe consignee's address is the name of the individual.The customs procedure is treated as simplified customs clearance with respect to the goods.

When you receive the cargo, you will be charged a tax calledpostagewill be collected.

However, even if the goods are intended for personal use, if China Customs determines that the price or quantity exceeds the scope of personal use, they may be treated as general customs clearance like commercial shipments.

In this case, the Import duties, consumption tax, and import value-added taxand other fees will be collected.

Procedures for Commercial Cargo

Commercial freight is defined asShipments where the consignee's address is in the name of the companyCustoms procedures are general customs clearance (normal customs clearance) in)Treatment.

General customs clearance (ordinary customs clearance) shipments must be declared to China Customs by an international freight forwarding agency or trading company that holds an import declaration license.

In addition to import duties, import value-added tax, consumption tax (also called luxury tax), and other taxes must be paid upon receipt of cargo. In addition to import duties, various taxes such as import value-added tax, consumption tax (also called luxury tax), etc. must be paid when receiving cargo.

Back to Table of Contents2. What goods cannot be sent to China?

If you use EMS (Express Mail Service) or private courier service (international courier service)Civil Aeronautics Laws and RegulationsYou cannot send items that are prohibited by the

Specific prohibited items include spray cans, gas for cassette stoves, charcoal, sunscreen, hair tonic, e-cigarettes, nail polish, perfume, nail polish, fireworks and crackers, alcohol exceeding 24 degrees alcohol by volume, bleach, mobile batteries, liquid batteries, and single lithium batteries.

Of course, explosives, hazardous materials, narcotics, live animals, and obscene items are also prohibited items.

If the name of the item on the invoice or invoice corresponds to a prohibited item, the EMS or courier pickup counter representative will refuse to accept the shipment.

In addition, some pet food and food products are banned for import by the Chinese government on its own. We recommend that you check with the customer service department of the shipping company before sending your shipment for the first time.

3. What is not personal cargo?

Even if the goods are addressed to an individual residing in China, if they fall under any of the following two categories, they may not be treated as personal shipments because they are considered by China Customs to be for business purposes such as resale (commercial goods).

(1) If the amount of the cargo exceeds the regulations

If the total value of one shipment (total invoice value) exceeds RMB 1,000, the shipment is considered to be beyond the scope of personal shipment and may be subject to the same general customs clearance as commercial shipments.

Exchange rates fluctuate, so be sure to check the rate at the time of shipment.

If sent as a personal shipment, it must be one of the following four patterns

Four shipping patterns that will be treated as private shipments

- Shipment of 2 items A x 2 (subtotal RMB 300) and 3 items B x 3 (subtotal RMB 600) in one shipment (total RMB 900).

- Item Ax8 (total value 950 yuan) shipped in one shipment.

- Shipping a single item (only one) of goods A over 1000 yuan.

- Shipping only one set of items (item A and item A") valued at over NT$1,000.

*Final decision, however, is at the discretion of the customs office.

(ii) When the quantity of the cargo is beyond the category of personal use

If the number of items in the shipment is large, it may be judged to be beyond the scope of personal shipment and be treated as a general customs clearance, the same as commercial shipments.

Normally, it is said that up to 10 items of the same type or design may be shipped, but less than 10 items may not be considered personal shipments.

Although the final decision rests with customs, we recommend that you check with the carrier or the store of purchase in advance how many pieces you can send if you are sending items with strict quantity limits, such as luxury watches, infant formula, or health supplements.

Back to Table of Contents4. Are customs duties charged on personal shipments?

Even personal shipments are subject to a customs duty called postal tax.

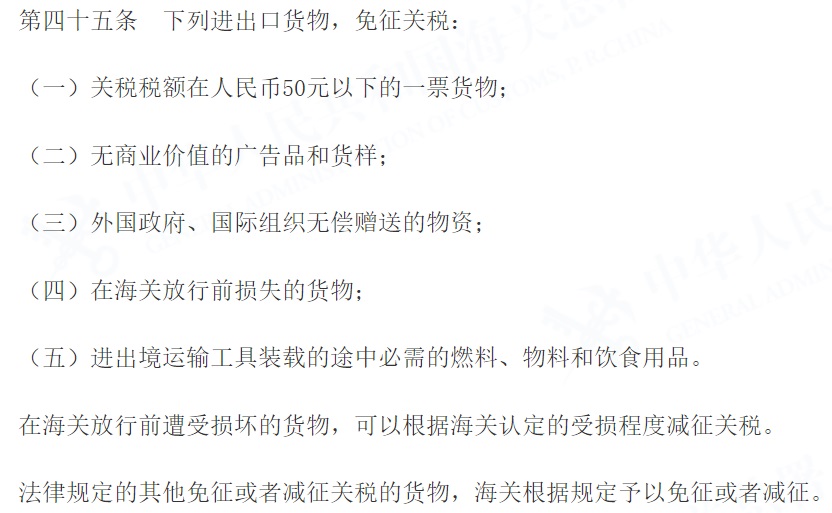

However, according to Article 45 (1) of the Import and Export Tariff Ordinance, the total amount of duties on one shipment is less than RMB 50, and advertising goods and sample goods that have no commercial value are exempt from duty collection.

The amount of duty is calculated by multiplying the declared value of the goods (invoice value) by the tax rate set by the Chinese customs authorities.

Total customs value = declared value (invoice value) x customs duty rate

1. import and export goods listed below are exempted from the collection of customs duties.

(1) Shipments with duty amount of RMB 50 or less per shipment; (2) Shipments with duty amount of RMB 50 or less per shipment

(2) Advertising and sample goods of no commercial value; and

(3) Goods donated free of charge by a foreign government or international organization; and

(4) Goods lost prior to clearance at Customs; and

(5) Fuel, materials, and food and beverage supplies required in transit to be loaded on the inbound and outbound means of transportation

2. for goods damaged prior to clearance at customs, duty collection will be reduced according to the degree of damage as certified by customs.

3. with respect to goods exempted or relieved from the collection of other customs duties prescribed by law, Customs shall exempt or relieve the collection of such duties in accordance with the regulations.

5. What is the duty rate on personal shipments?

The rate of customs duty (postal tax) on personal shipments will be revised on April 9, 2019, and the rate for 'Food, Beverages, Drugs and Supplements' will be reduced from 151 TP2T to13%.From 25% for Clothing, shoes, sundries, cosmetics, and electrical goods" range from 25% to20%The Branded luxury goods (watches, etc.) are kept as they are.50%.The company was

Details are provided in the Customs General Administration of the People's Republic of China Entry Border Goods Classification Schedule (General Administration of Customs of the People's Republic of China No. 63 of 2019 / effective April 9, 2019).

Click here to download the Japanese translation.

6. Who pays customs duties on personal shipments?

It is usually the consignee who pays customs duties on personal shipments. If customs duties are not paid, the consignee will not receive the shipment in principle.

However, private courier services (International Courier Service) and Japan Post's UGS (Yu Global Express) accept shipper's payment (prepaid) for customs duties.

7. What happens if I do not pay the customs duty?

Shipments for which customs duties are not paid will not be delivered to the consignee.

It will be destroyed locally in China or returned to the sender of the shipment (Japan).

So who pays for the cost when it is returned to Japan?

In the case of EMS, as a rule, there is no charge for fees incurred in returning items from overseas.

However, other private courier services (international courier services), international parcels, small packages, international e-packets, etc. will charge the sender for the cost of return shipping (transportation, customs, and other expenses).

Back to Table of Contents8. Personal shipment invoice pricing

When sending goods to China, whether by EMS or private courier service (international courier service), it is essential to make a waybill and an invoice (INVOICE).

An invoice is simply a price statement of the contents.

Since Chinese customs determines the amount of tax based on the product name, quantity, and price information on the invoice, it is essential that the information be correct.

For the price, write the price of the item at the time it was purchased. If you forget or are unsure of the price of an item, look up the price of a similar product and write it down.

If you list a price lower than the actual value of the item because of customs duties, you may be stopped by Chinese customs and charged a higher duty based on customs judgment.

Back to Table of Contents9. if the value of the shipment exceeds NT$1,000

If the invoice value of an individual shipment exceeds 1000 yuan (approx. 14,000-15,000 yen), the shipment will be divided into multiple smaller shipments.

For example, if you send an 8,000-yen dress and 12,000-yen shoes in a single shipment, the cost will exceed 1,000 yuan, but you can send the 8,000-yen dress and 12,000-yen shoes as two separate shipments by preparing an invoice and invoice for each.

However, transportation costs will be higher since freight and local customs duties will be charged for the two shipments.

Back to Table of Contents10. What documents are required by Chinese customs?

The consignee in China is required to submit a copy of his/her identification card for customs clearance of the shipment, while the shipper is not required to do so.

In addition, if the invoice price (declared price) of a shipment is questioned by Chinese customs, you may be asked to submit a receipt (i.e., receipt) of the purchase to prove the item price.

There is no specified format or form for receipts, but handwritten receipts or receipts from small, unknown duty-free stores may not be believed.

Conversely, receipts from famous Japanese department stores (Isetan, Takashimaya) and major drugstores (Daikoku Drug, Matsumotokiyoshi, Sandlac) are easier to be believed.

Chinese customs has a large amount of data and determines the validity of declared prices based on past customs clearance data.

If an item that was listed as 9,000 yen in past customs databases is declared with an invoice price of 1,000 yen, we would naturally be suspicious.

Ultimately, the customs officer will make the final decision, but there is no problem as long as the amount shown on the receipt or receipts you received when you made the purchase is listed.

Back to Table of Contents